|

|

Repayment Mortgages

Interest-Only Mortgages

|

|

|

|

|

|

|

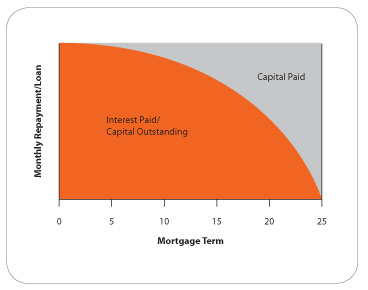

Your monthly payments only cover the actual interest charged on your loan, and do not actually reducing the loan itself. It is therefore important that you arrange some other way to repay the loan at the end of the term in one lump sum (i.e. setting up a suitable investment or savings plan). |

|

|

By choosing this option you will need to check your investment or savings plan regularly, thus ensuring there are sufficient funds to repay your loan at the end of its term. If your savings or investment plan doesn’t grow according to what was predicted, then you will have a shortfall and will have to think about ways of making this up. |

|

|

Because this type of repayment method means that you are only paying off the interest, and not the loan itself, your monthly payments will be lower, but this will not increase the equity in your home. This repayment method is suitable if you wish to self-manage the repayment of your loan - typically from the proceeds of selling your home, receiving an inheritance, or savings and investment plans. |

|

|

It is your responsibility to ensure an adequate repayment method is in place, and if you can't repay it at the end of the term, you could lose your home. |

|

Combined Mortgages

Your monthly payments when combined, means a portion of the loan is treated as a repayment mortgage, and a portion as an interest only mortgage. You will be using both repayment and interest-only methods, to repay the outstanding loan therefore.

This type of mortgage maybe suitable if you already have an existing investment plan in place, or have recently set one up and are considering taking on a new mortgage. For example, if you want to take out a £200,000 new mortgage loan but already have an investment plan that could pay out £100,000 in a number of years time Then you could consider an interest-only element to cover the first £100,000 and a repayment element for the remaining £100,000.

Thinkofmortgages.Com is a trading name of Thinkofmortgages Ltd who are an Appointed Representative of PRIMIS Mortgage Network, a trading name of Personal Touch Financial Services Ltd. Personal Touch Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

We may charge you a fee for mortgage advice. The exact amount will depend on your needs and circumstances. Our typical fee is £399.

|

|

|

|

---orange.gif)